Case Study: Quickly Changing and Improving Healthcare Payment Solutions

OVERVIEW

Doctoranytime is a leading health tech company in Greece, Belgium, and expanding in LATAM. They assist people daily in finding the right medical services, offering guidance on health matters and connecting them with the right practitioners conveniently.

Our team's mission is to discover and deliver ways to increase the company's revenue.

I took charge of research and design for this mission. The research I did proved that there is a need to pivot to a better solution – a faster and more efficient way to help practitioners.

HIGHLIGHTS

The pivot doubled the revenue from video consultations.

The research discovery plan saved us from potentially spending months or years on development and thought us to focus on more pressing concerns.

My Role

Product Designer

Team

Product Manager

Product Designer

Tech Lead

Back-end Developer

Front-end Developer

UX Writer

Process

Competitor Analysis

Surveys

Semi-Structured Interviews

Quantitative Data Analysis

Heuristic Evaluation

Ideation

Prototyping

Usability Testing

Evaluation

Tools

Figma

Figjam

Miro

Notion

Google Analytics

Gmeet

Grain

Hubspot

Typeform

CONTEXT

There were complaints from practitioners about patient no-shows and last-minute cancellations.

Our hypothesis? Expanding online payment options to include physical appointments and asynchronous services would enhance patient convenience, boost practitioner productivity, and drive higher adoption rates and revenue growth.

MEASURE

To assess our product's success, we considered metrics such as:

Revenue from online patient payments, the number of appointments paid online, the ratio of online payments to total appointments, and healthcare practitioners’ revenue growth through online payments.

DESIGN PROCESS

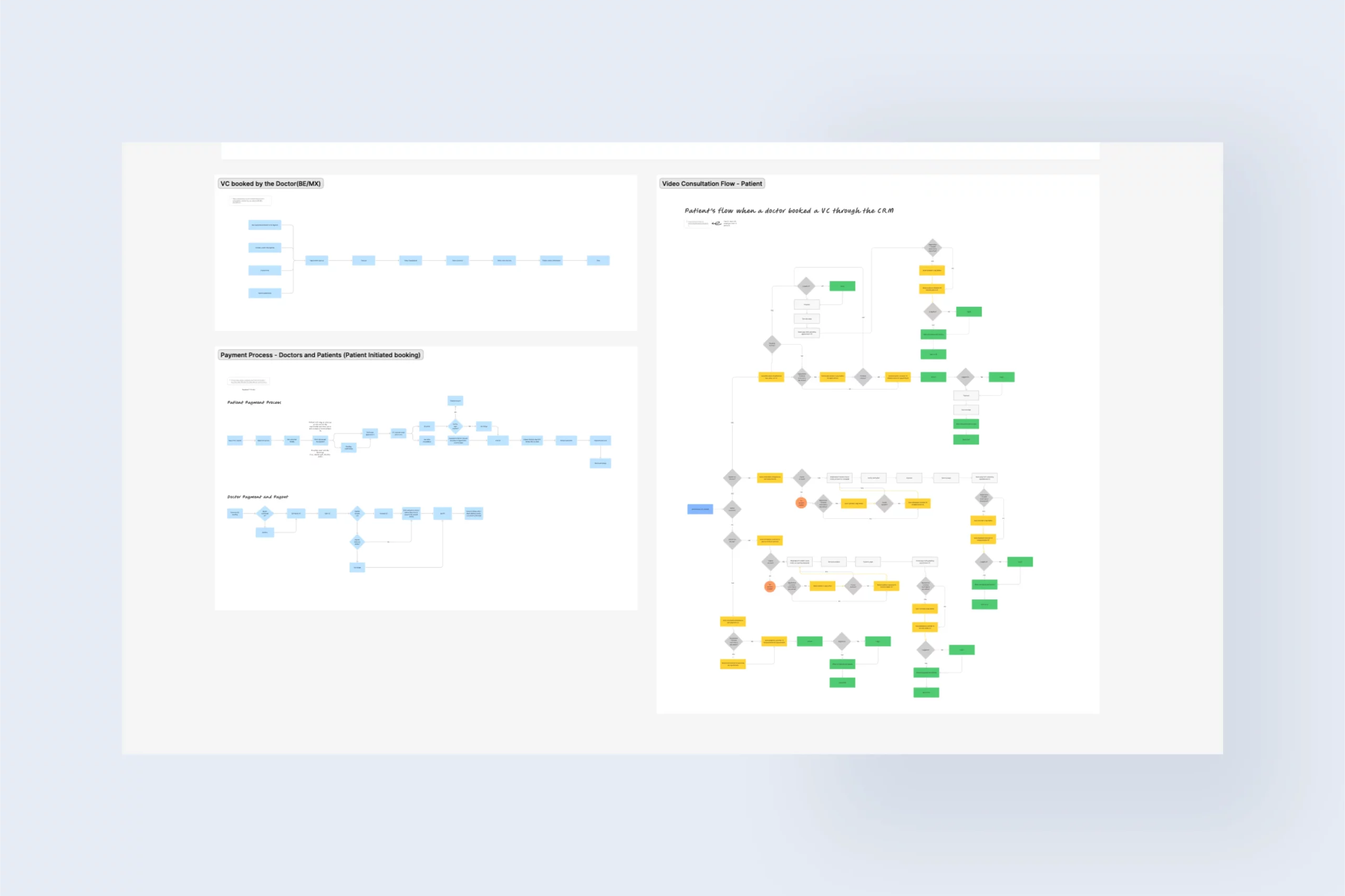

Create a Research Discovery Plan

I crafted a research plan focused on practitioners’ preferences for online payments on Doctoranytime, aligning it with our revenue growth objective. We kicked off our investigations in our primary domain, where most doctors scheduled appointments for their patients. A selected group of practitioners underwent hypothesis testing to eliminate potential payment issues.

Analyze User Insights and Mitigate Bias

Building upon prior research conducted three years ago, I designed survey questions and conducted follow-up interviews. Our aim? To mitigate biases by actively listening to our users’ perspectives.

Maximize Timeline Efficiently

Simultaneously, we analyzed the current payment flow within the platform, enhancing usability and integrating features aligned with our survey findings. Practitioner usability testing followed interviews, accelerating our results.

Mobile payment

80.3% of the respondent practitioners already have mobile payments in Belgium through Payconiq.

No-show policy

50.5% of them have no-show policy in place.

Prepayments

Low number of practitioners need prepayment. Prepayments are only needed for new patients.

Relationship

Strong patient professional relationship. The practitioners trust their patients.

KEY DISCOVERY

Online payments proved highly effective for specific practitioner types but were not universally applicable.

- The window of opportunity for mobile payments had passed, making it less impactful.

- About half of the doctors already had established no-show policies, providing an opportunity for compensation streamlining.

- Prepayments are primarily for new patients via Doctoranytime, helping to dodge cancellations and no-shows.

- Doctors trust their regular patients and are content with bank transfers for services like Prescription renewal.

PIVOT

A compelling need for another payment solution did not surface, leading us to focus on optimizing the existing payment flow.

Initially, there wasn’t a compelling need for yet another payment solution, so we shifted our focus to optimizing the existing payment process. The question that arose was, what could we do to assist practitioners who displayed a keen interest in online payments without investing heavily in development?

SOLUTION

A solution to offer cheaper options for card payments

Nearly half of our survey participants, precisely 44.6%, are worried about the expense associated with our payment solution. To address this concern, we’re exploring the possibility of leveraging Stripe’s mobile POS terminal, which comes at a more affordable package cost. This solution is high on our priority list for the future.

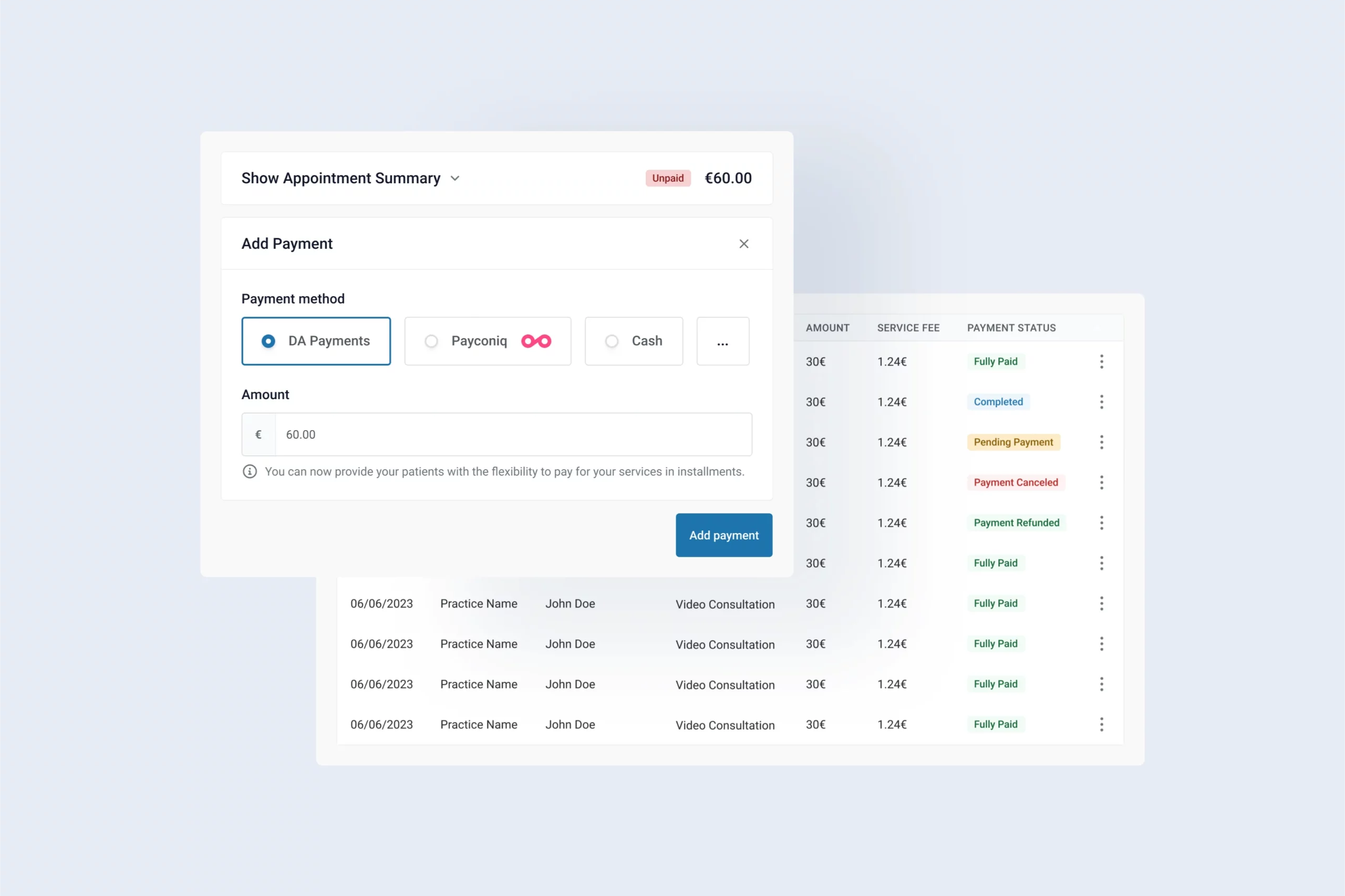

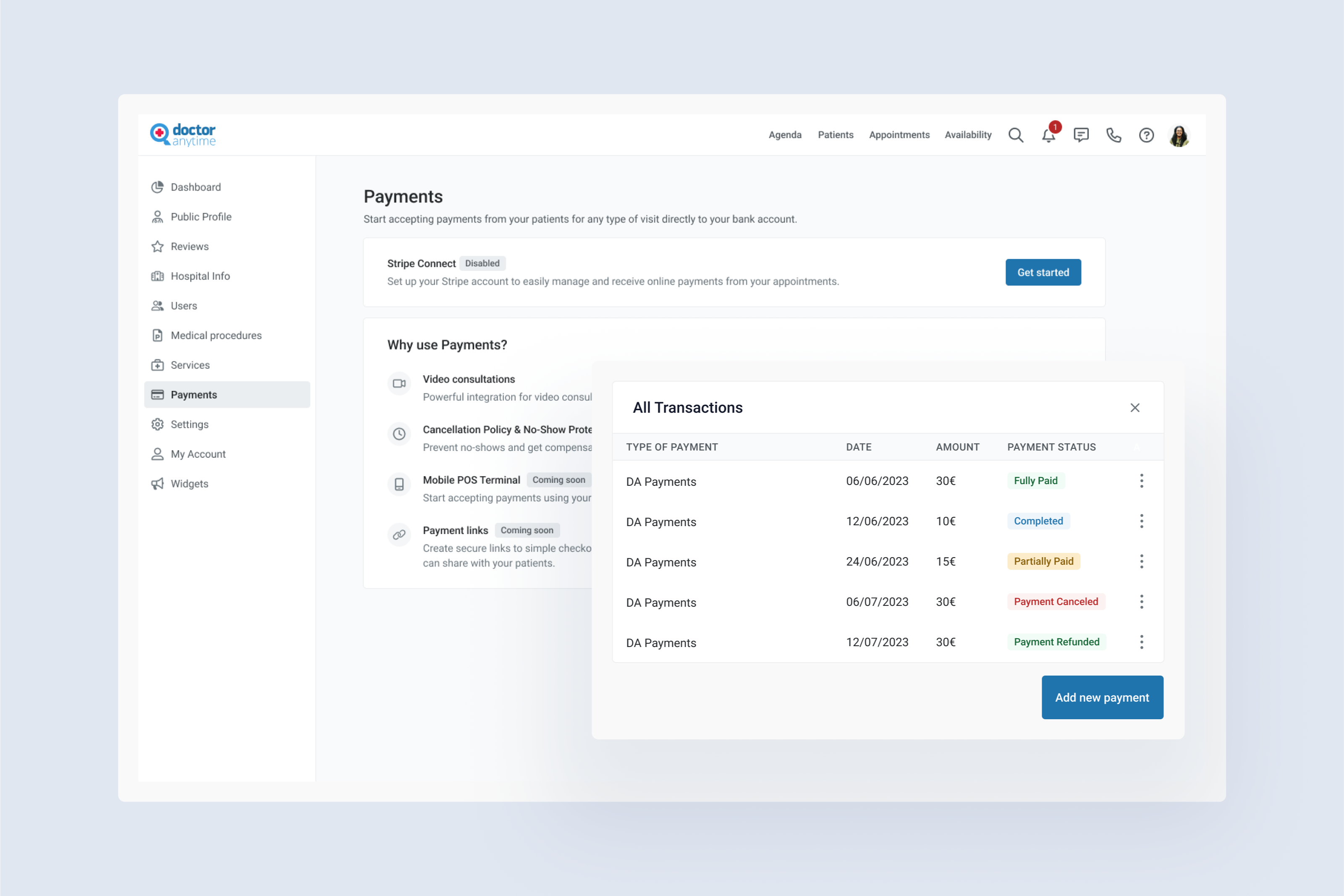

A solution to utilize existing payment solution

We contemplated utilizing our current payment solution. Could it suffice for practitioners in need of online payment capabilities? Our strategy involved rolling it out to all practitioners while ensuring they were well-informed about its advantages.

Take a Step Back

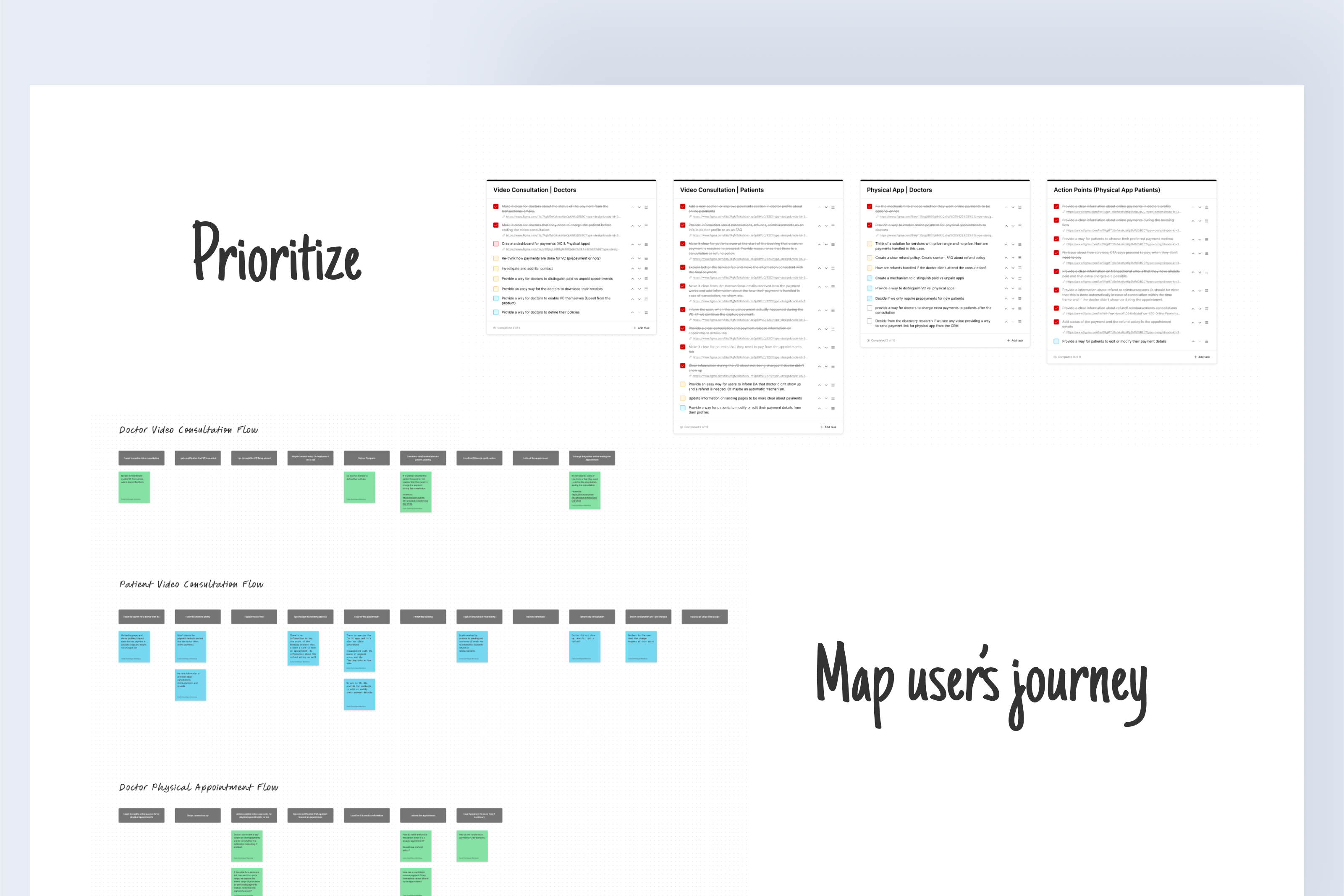

However, we couldn’t ignore the existing issues within our payment system. I revisited the stakeholder survey and support tickets to identify the reported issues. By pinpointing the most problematic stages in the user journey, I created a priority table for discussion with the team to determine our focus areas.

Evaluate new discovery

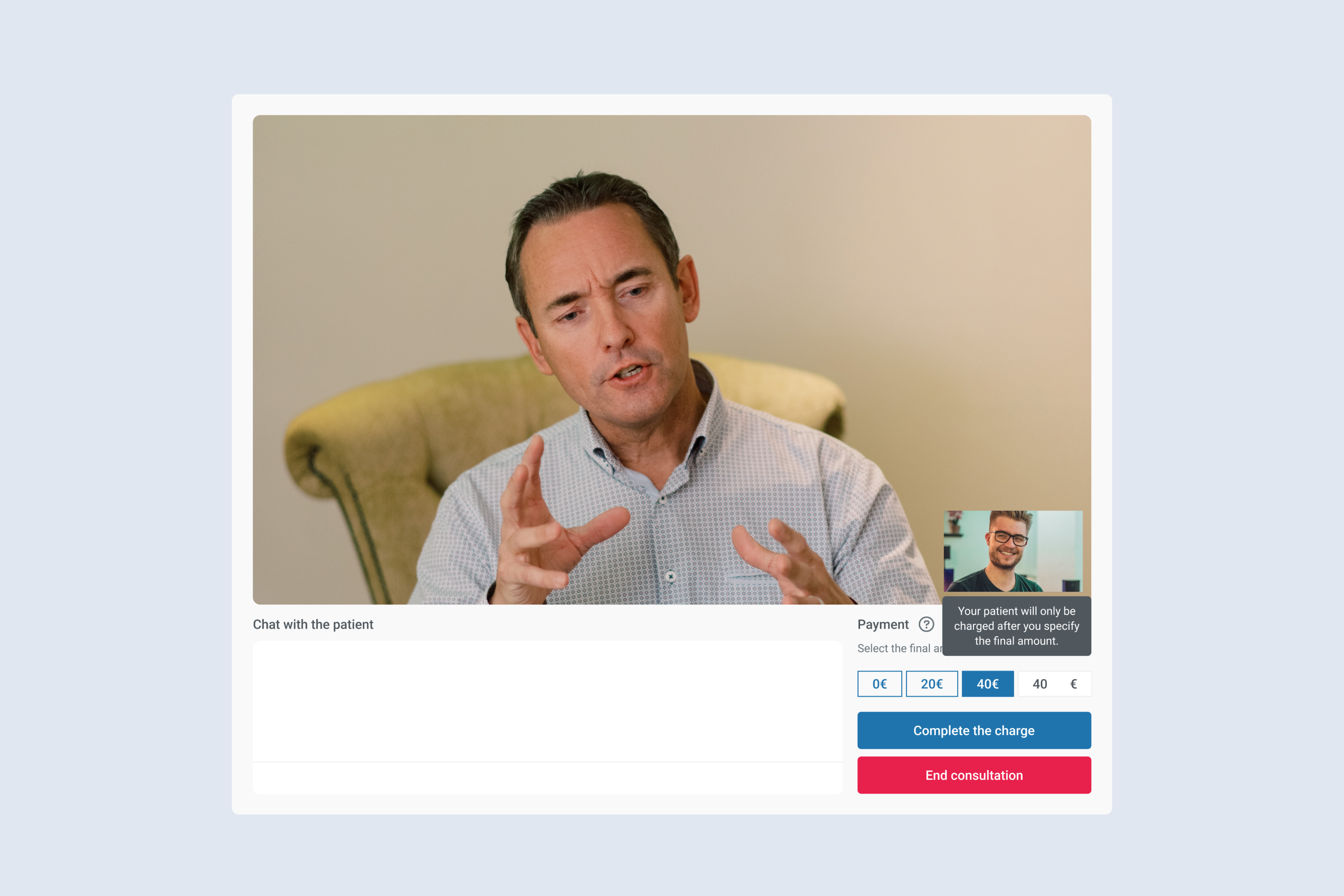

Three critical insights emerged. First, practitioners were unaware of the need to manually charge patients at the end of a video consultation. Second, patients believed they had already prepaid their appointments. Third, patients in Belgium have issues paying with a card with the current payment system we have.

DESIGN

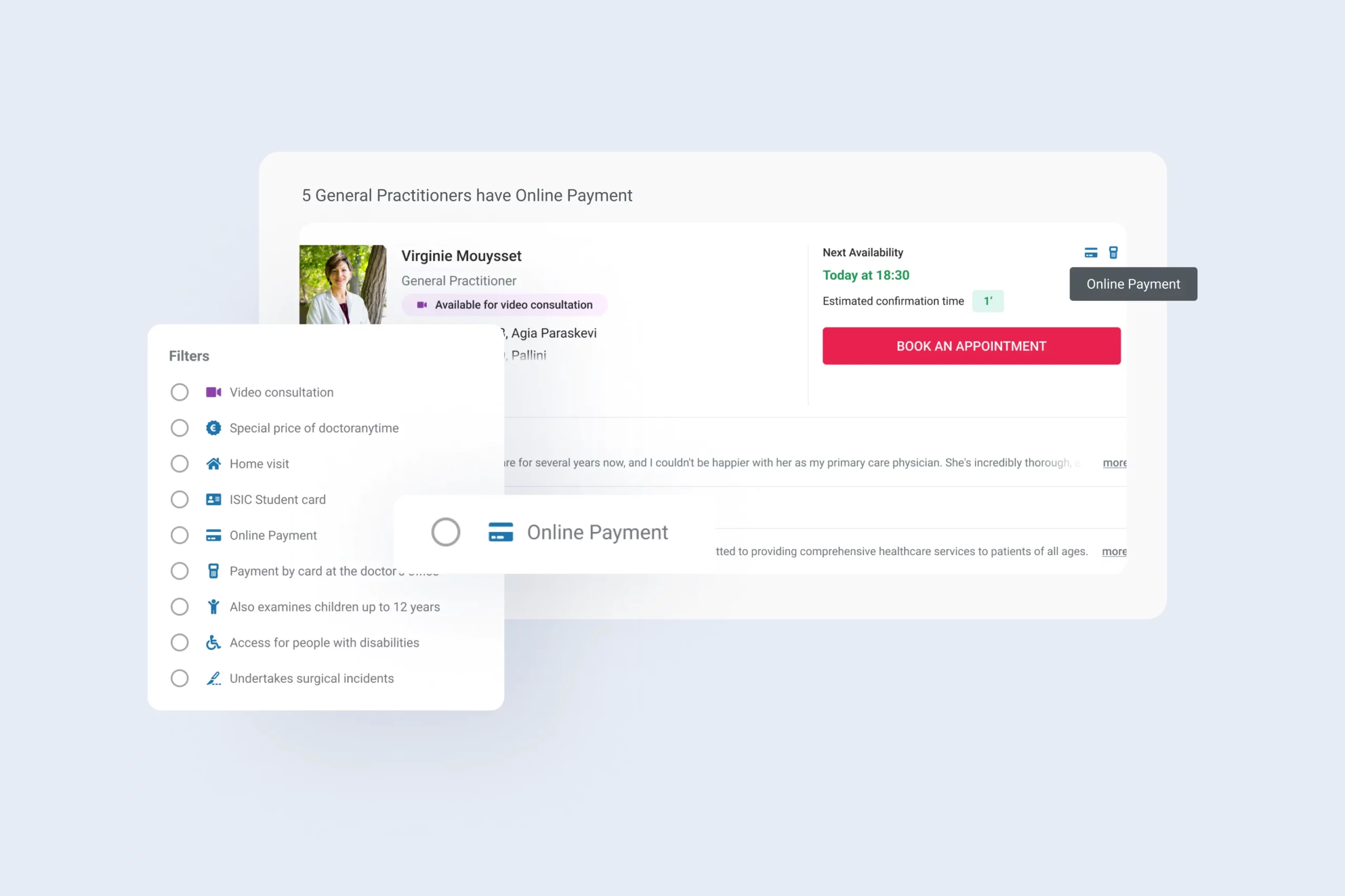

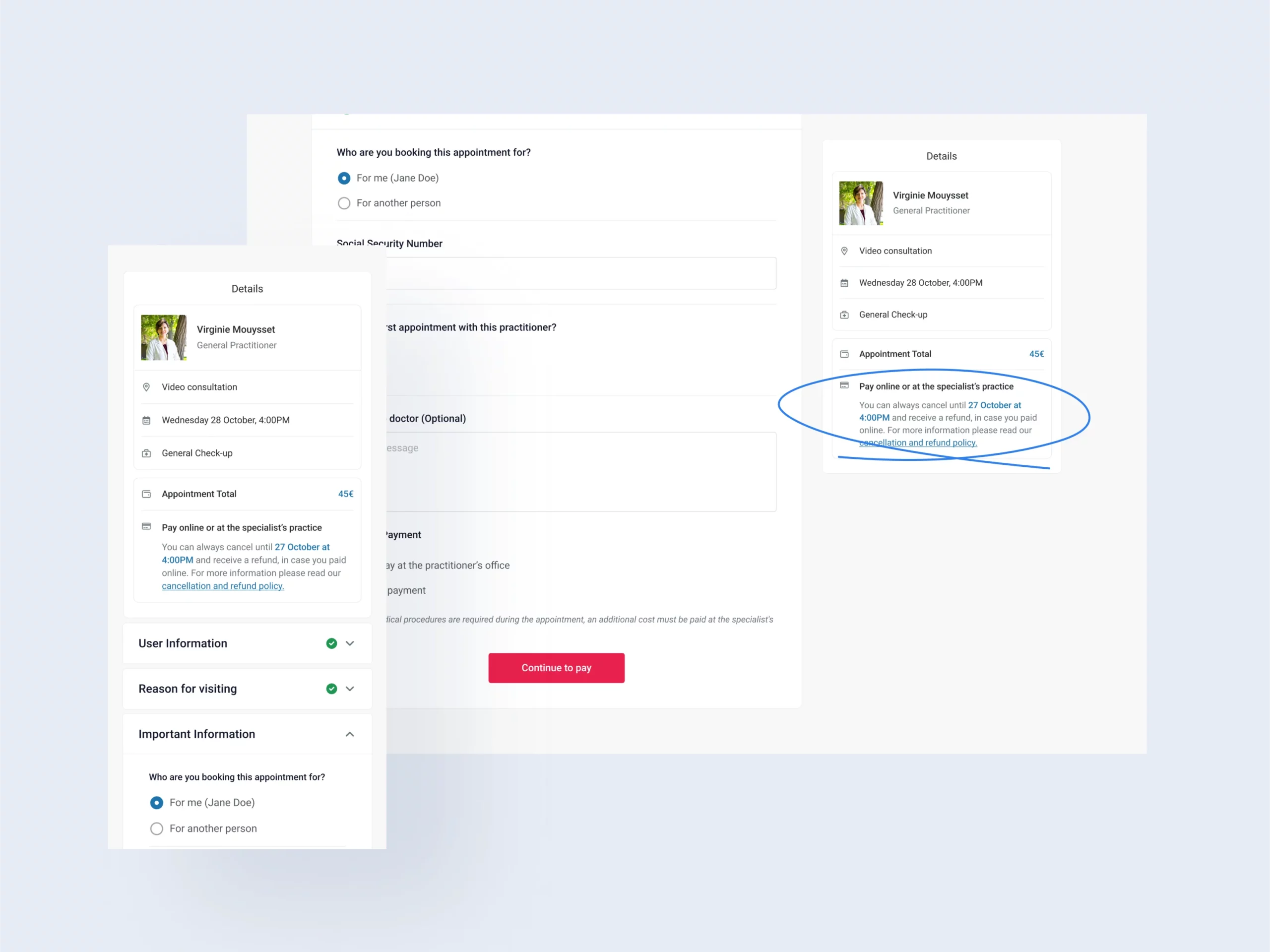

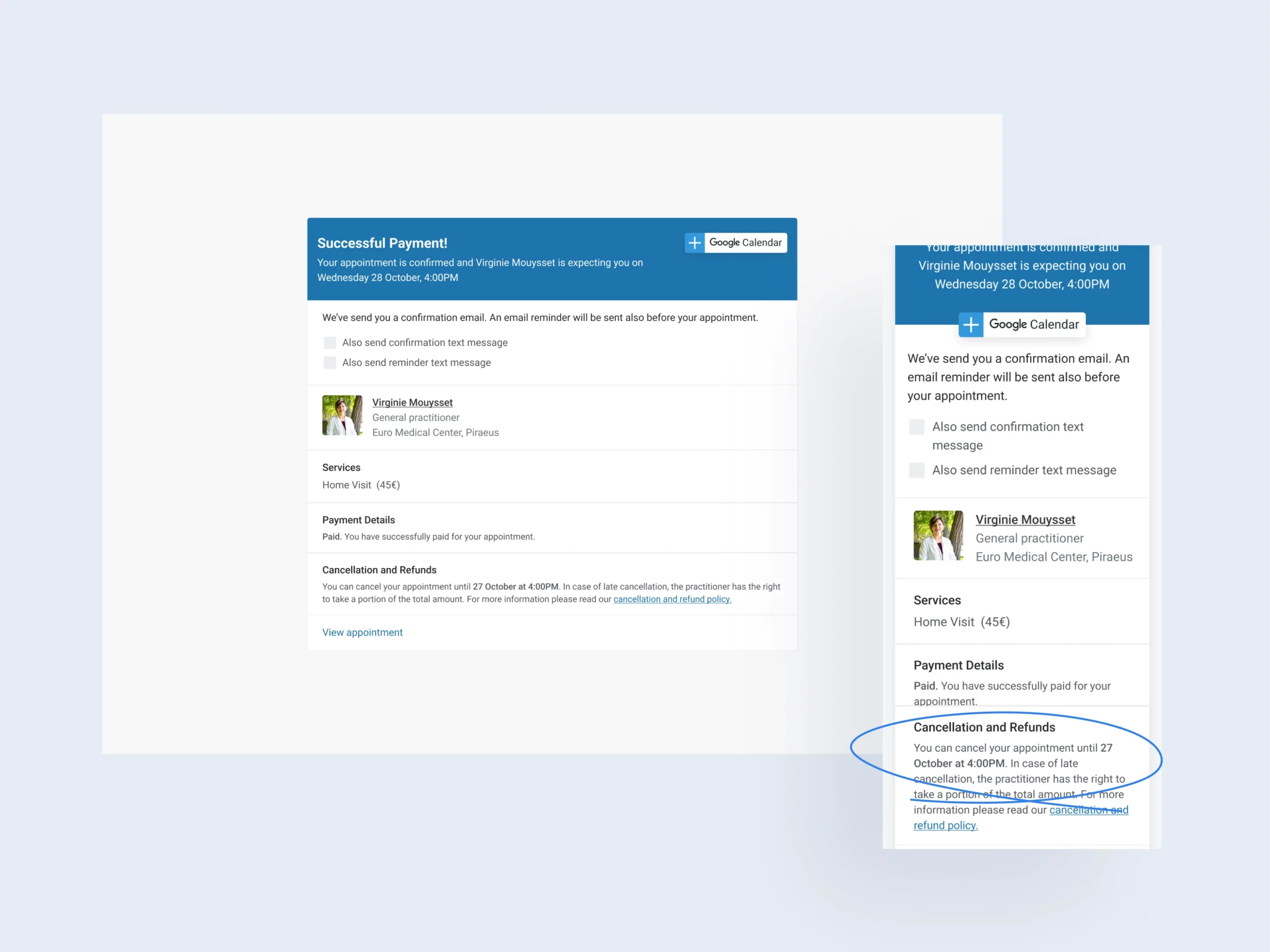

An optimized payment flow for patients

To address these issues, I designed an improved payment process for patients, incorporating new payment information into the existing search and booking procedure to educate patients about their payment options.

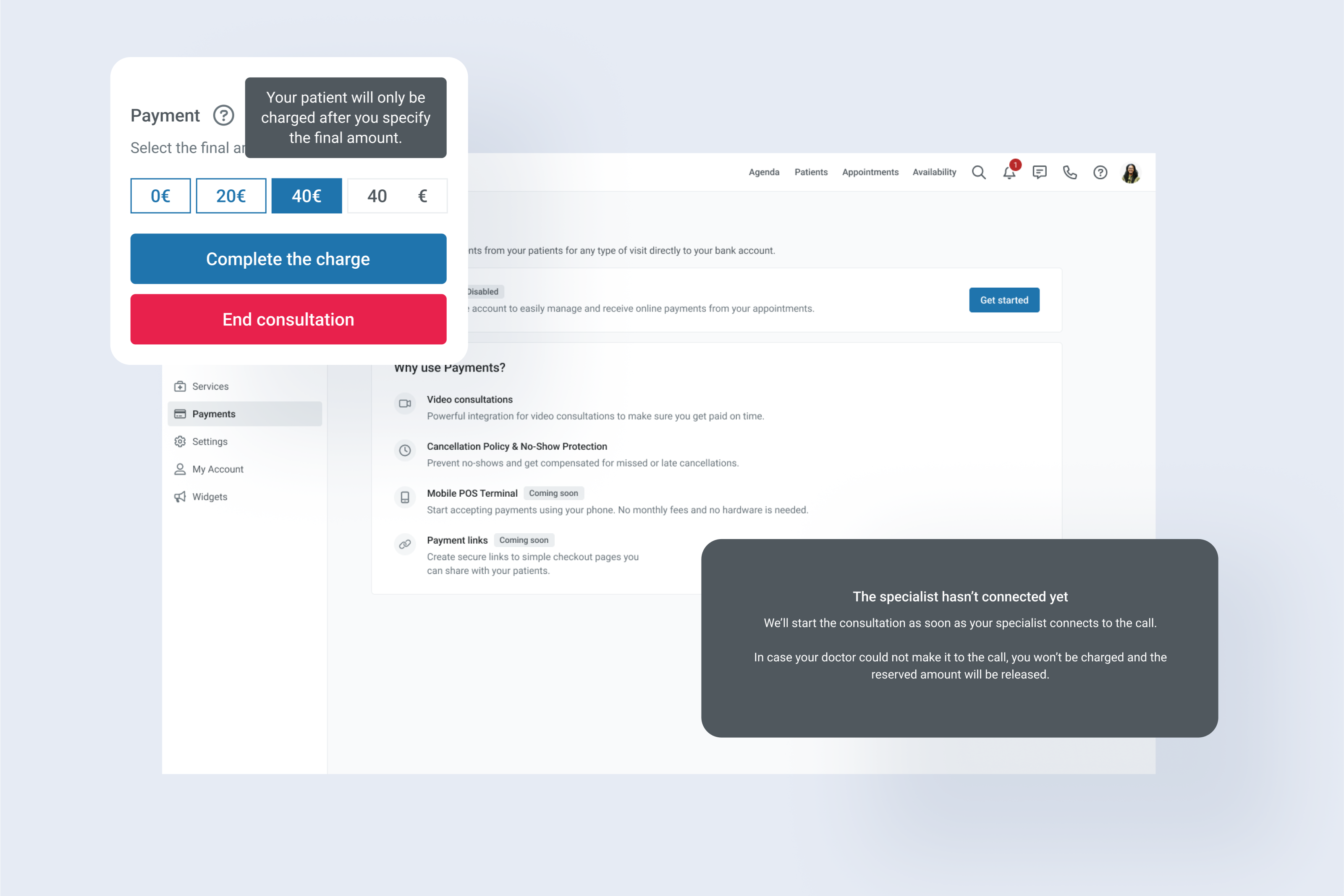

A clearer Interface for Practitioners

I revamped the practitioner interface, making it more intuitive and providing prompts in case a practitioner closed the web browser without completing the payment process.

NEW INTEGRATION

Easier payments for patients in Belgium

The card payment issues they were having was solved by integrating Bancontact on our means of payment.

IMPACT

Increased the revenue from Video Consultations by 100%

The updates on the video consultation payments flow and the new integration doubled the revenue coming from video consultation bookings.

NEXT STEPS

- Monitor the number of practitioners showing interest from the payments tab

- Explore the possibility of instant payments

- Dive more into mobile POS through Stripe to offer cheaper options for doctors to accept payments

RETROSPECTIVE & LESSONS LEARNED

Looking back, here are some learnings:

- We recognized the importance of embracing ambiguity and fostering creative problem-solving within practical constraints. Designing without clear constraints proved to be a mistake that extended our timeline.

- Engaging our tech team members early in the process became essential to consider the entire user flow comprehensively. Despite conducting a thorough examination of the current flow, some technical nuances only surfaced when a more technically inclined team member was involved.

- We acknowledged that embracing “failure” as a stepping stone to rapid iteration and continuous improvement was crucial. Failure is inevitable, especially in product development, but it’s an integral part of the learning process.

- This project also highlighted the significance of managing design debts. We realized that using outdated and inconsistent design elements, despite the existence of a more current design system, was inefficient. We learned the importance of early discussions with the team to emphasize the need for minimizing design debt for long-term efficiency.

-

Since the new update has been rolled out to all users, we could have reduced the risk of impacting important metrics like conversion rate by conducting an A/B test before the release.